In today’s dynamic financial landscape, selecting the best online stock brokers is crucial for individuals looking to maximize their investment opportunities. With an array of online brokerage accounts and trading platforms available, it’s essential to choose a platform that aligns with your trading needs and preferences.

In this article, we will delve into the world of stock trading apps and online brokers, exploring the top contenders for the title of the best stock brokers in 2023. Whether you are a seasoned investor or a beginner eager to explore the stock market, we have compiled a comprehensive list of the most reputable and feature-rich platforms to suit your trading ambitions.

So, let’s dive in and discover the best brokerage accounts and trading platforms that can help you navigate the exciting world of stock trading in 2023.

What to Look for in a Stock Broker

When it comes to selecting the best stock broker for your trading needs, there are several key factors that you should consider. The right broker can greatly impact your trading success and overall experience in the market. Let’s delve into the essential elements to look for when choosing a stock broker in 2023.

1. Reliability, Reputation, and Security:

Reliability is paramount in the world of stock trading. You want a broker that you can trust to execute your trades accurately and efficiently. Reputation plays a crucial role in assessing a broker’s reliability. Look for brokers with a solid track record, positive customer reviews, and a strong presence in the industry.

Security is another critical aspect to consider. With cyber threats on the rise, it’s essential to choose a broker that prioritizes the safety of your personal and financial information. Opt for brokers who employ robust security measures, such as encryption and two-factor authentication, to safeguard your account.

2. User-Friendly Trading Platform:

A user-friendly trading platform can significantly enhance your trading experience. Look for brokers that offer intuitive and well-designed platforms. These platforms should provide a seamless and efficient trading experience, allowing you to execute trades with ease.

The best trading platforms in 2023 will offer advanced features such as real-time market data, customizable charts, and integrated research tools. They should also support various order types, including market orders, limit orders, and stop orders, empowering you to implement your trading strategies effectively.

3. Mobile Trading Apps:

In today’s fast-paced world, having access to your trading account on the go is essential. Stock trading apps have gained immense popularity, allowing investors to monitor the market and execute trades from their mobile devices.

The best stock brokers in 2023 will provide robust mobile trading apps that offer a seamless and secure trading experience. These apps should be compatible with both iOS and Android devices, offering features such as real-time quotes, order placement, account management, and market news updates.

By considering these key factors – reliability, reputation, security, and a user-friendly trading platform – you can narrow down your options and choose a stock broker that aligns with your trading goals and preferences.

Top Stock Brokers for Stock Market Investing

1. TD Ameritrade

TD Ameritrade is undeniably one of the best brokerage options for stock market investing in 2023. With its extensive range of features and services, it caters to both beginner and experienced investors, making it an excellent choice for individuals looking to trade stocks.

TD Ameritrade offers a comprehensive suite of tools and resources that empower investors to make informed decisions. Its advanced trading platform provides real-time market data, customizable charts, and technical analysis tools. This platform stands out as one of the best stock trading apps available, allowing users to access their accounts and trade on the go.

Pros:

- TD Ameritrade boasts one of the best trading platforms, offering a seamless trading experience with advanced charting tools and real-time market data.

- The brokerage provides a wide range of investment options, including stocks, exchange-traded funds (ETFs), options, futures, and mutual funds.

- It offers a diverse selection of research and educational resources to assist investors in making informed decisions.

- TD Ameritrade provides excellent customer support, with multiple channels available for assistance.

Cons:

- While TD Ameritrade offers competitive pricing, some may find its commission fees slightly higher compared to other online brokers.

- Beginner investors might feel overwhelmed by the platform’s extensive features and resources, requiring some time to familiarize themselves with its functionality.

2. Charles Schwab

Charles Schwab is one of the leading online brokerage firms, known for its comprehensive range of features and services. Let’s take a closer look at what sets Charles Schwab apart as one of the best stock brokers in 2023.

Features and Services:

- Best Brokerage Accounts: Charles Schwab provides a variety of brokerage accounts suitable for different investor needs, including individual, joint, retirement, and custodial accounts. This flexibility ensures accessibility for investors of all types.

- User-Friendly Trading Platform: Charles Schwab’s trading platform is known for its intuitive interface and user-friendly experience. Traders have access to advanced charting tools, real-time quotes, and customizable dashboards, empowering them to make informed decisions.

- Extensive Research Tools: Charles Schwab offers robust research tools that provide comprehensive market insights. From fundamental analysis to technical indicators, these tools keep investors well-informed and aid in making sound investment choices.

- Mobile Trading Apps: Recognizing the importance of mobile trading, Charles Schwab provides powerful stock trading apps. These apps enable users to monitor their portfolios, execute trades, and access real-time market data on the go, ensuring investors never miss an opportunity.

Pros:

- Diverse Investment Options: Charles Schwab offers a wide range of investment options, including stocks, bonds, mutual funds, ETFs, and more. This allows investors to build a well-diversified portfolio aligned with their investment goals and risk tolerance.

- Excellent Customer Service: Charles Schwab’s exceptional customer service sets it apart. Knowledgeable representatives are readily available to assist clients, providing prompt and reliable support when needed.

- Competitive Pricing: With low commissions and fees, Charles Schwab offers competitive pricing. This appeals to both frequent traders and long-term investors, helping them manage costs effectively.

Cons:

- High Minimum Balance: Charles Schwab has a higher minimum balance requirement for certain account types, potentially discouraging beginner investors with limited capital.

- Limited Forex Trading: While excelling in many areas, Charles Schwab does not provide extensive forex trading capabilities. Investors primarily interested in forex trading may prefer other brokerage options.

3. Fidelity Investments

Fidelity Investments is widely recognized as one of the best online brokerage firms in 2023. With its comprehensive suite of features and services, Fidelity caters to a diverse range of investors, from beginners to experienced traders.

Features and Services:

Fidelity Investments offers an array of features that make it an attractive option for traders and investors alike. Here are some key highlights:

- Best Trading Platform: Fidelity’s trading platform is user-friendly and packed with powerful tools. It provides real-time market data, advanced charting capabilities, and customizable layouts, empowering traders to make informed decisions.

- Extensive Research and Education: Fidelity offers a wealth of research and educational resources. Traders can access market insights, analyst reports, and in-depth company profiles, enabling them to stay updated and make well-informed investment choices.

- Mobile Trading Apps: Fidelity’s stock trading apps are highly rated and offer a seamless trading experience on the go. The apps provide access to real-time quotes, account information, and the ability to place trades from anywhere, making it convenient for active traders.

- Options Trading Platform: Fidelity boasts one of the best option trading platforms in the market. It offers advanced options tools, including strategy builders, options chains, and probability calculators, empowering options traders to execute their strategies effectively.

Pros:

- Wide range of investment options, including stocks, bonds, ETFs, mutual funds, and options.

- Awesome trading platform with advanced features and tools.

- Extensive research and educational resources to enhance investor knowledge.

- Strong customer support and responsive service.

- Competitive pricing and low fees compared to some other brokerage firms.

Cons:

- Higher minimum investment requirements compared to some other online brokers.

- Certain advanced trading features may be overwhelming for beginners.

- Limited availability of international markets for trading.

4. E*TRADE

ETRADE is renowned for its comprehensive suite of features and services, making it one of the best stock brokers in 2023. With its user-friendly platform and diverse offerings, ETRADE caters to both beginner and experienced traders.

Features and Services:

E*TRADE offers a range of features that set it apart from other online brokers. Here are some notable ones:

- Best Trading Platform: E*TRADE provides traders with an advanced and intuitive trading platform that offers real-time streaming quotes, customizable charts, and a wide range of technical analysis tools. The platform is highly responsive, ensuring a seamless trading experience.

- Extensive Research and Analysis: ETRADE offers comprehensive research tools to assist traders in making informed investment decisions. From fundamental analysis to third-party research reports, ETRADE equips traders with the necessary information to navigate the markets successfully.

- Wide Selection of Investment Options: Whether you’re interested in stocks, options, ETFs, or mutual funds, E*TRADE offers a diverse range of investment options to suit various trading strategies. This flexibility makes it an ideal choice for both long-term investors and active traders.

- Educational Resources: E*TRADE is committed to empowering traders with knowledge. They provide a vast array of educational resources, including webinars, articles, videos, and interactive courses. These resources are particularly beneficial for beginners looking to enhance their trading skills.

Pros:

- Robust and user-friendly trading platform.

- Extensive research tools and analysis capabilities.

- Wide selection of investment options.

- Educational resources for traders of all experience levels.

- Competitive pricing and transparent fee structure.

- Strong customer support.

Cons:

- Some advanced features may be overwhelming for beginners.

- Inactivity fees may apply if the account is not used frequently.

- Certain advanced trading tools may have additional fees.

5. Interactive Brokers

Interactive Brokers is widely recognized as one of the best stock brokers in 2023, offering a comprehensive suite of features and services for traders. With a strong reputation in the industry, they have earned the trust of both professional and individual investors. Let’s take a closer look at what makes Interactive Brokers stand out.

Features and Services:

Interactive Brokers provides a robust trading platform that caters to the needs of all types of traders. Here are some key features and services offered by Interactive Brokers:

- Best Trading Platform: Interactive Brokers boasts one of the best trading platforms available, providing users with a seamless and efficient trading experience. Their platform is known for its advanced tools, customizable interface, and real-time market data, allowing traders to make informed decisions.

- Extensive Product Offering: With Interactive Brokers, you gain access to a wide range of investment options. From stocks and bonds to options and futures, they offer a diverse product portfolio to suit various trading strategies.

- Low Costs and Competitive Pricing: Interactive Brokers is known for its competitive pricing structure. They offer low commissions and fees, making it an attractive choice for cost-conscious traders. Additionally, their transparent fee structure ensures that you know exactly what you’re paying for.

- Advanced Trading Tools: Interactive Brokers provides a comprehensive set of trading tools and resources to enhance your trading experience. From real-time market data and research reports to advanced charting capabilities, these tools empower traders to analyze the markets and execute trades with confidence.

- Global Market Access: With Interactive Brokers, you can trade in multiple markets across the globe. They provide access to over 135 markets in 33 countries, enabling you to diversify your portfolio and seize opportunities in international markets.

Pros:

- Robust and user-friendly trading platform

- Extensive product offering, including stocks, options, and futures

- Low commissions and fees, making it cost-effective for traders

- Advanced trading tools and research resources

- Global market access for international trading opportunities

Cons:

- Interactive Brokers may have a steeper learning curve for beginners due to its advanced features and interface.

- Some users have reported that customer support can be slow at times.

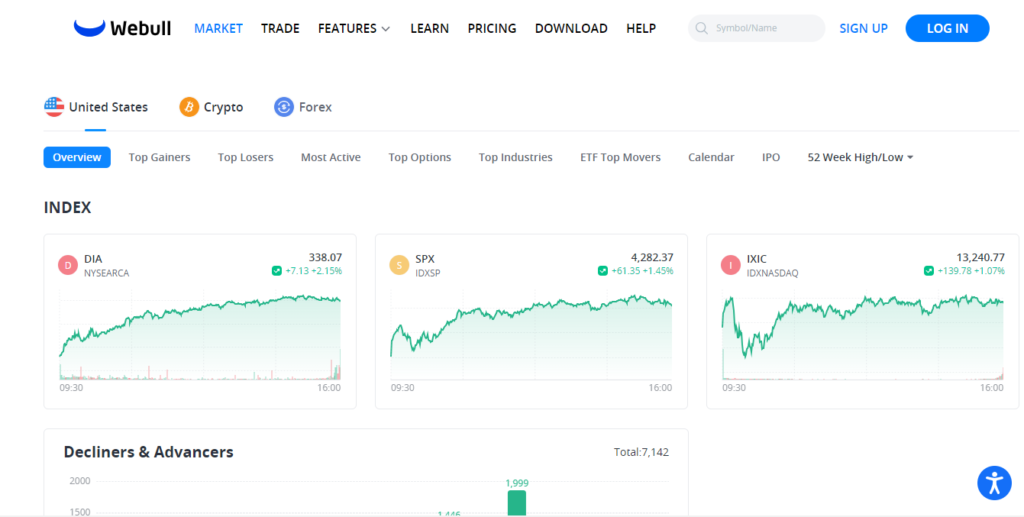

6. Webull

Webull is a leading online brokerage that has gained popularity for its robust trading platform and an array of features. Whether you are a seasoned trader or just starting out, Webull offers a user-friendly interface coupled with advanced tools and educational resources to enhance your trading experience. Let’s dive into the pros and cons of using Webull as your preferred stock trading platform in 2023.

Pros:

- Extensive research and analysis tools

- Zero commission trading

- Wide range of investment options

- Paper trading

Cons:

- Phone support is not available

- Lack of Mutual Funds

7. Merrill Edge® Self-Directed

Merrill Edge® Self-Directed is a prominent online brokerage platform that caters to both beginner and experienced traders. It offers a comprehensive suite of investment tools, research resources, and a user-friendly interface to facilitate seamless trading experiences. As a subsidiary of Bank of America, Merrill Edge® combines the expertise of a renowned financial institution with the convenience of online trading.

Pros:

- Best brokerage accounts for beginners

- Robust trading platform

- Integration with Bank of America accounts

- Offers comprehensive research reports, analyst ratings, and advanced screening tools to assist traders in making informed investment decisions.

- Wide range of investment options

Cons:

- Limited international market access

- High fees for active traders

- Limited customization options

8. J.P. Morgan Self-Directed Investing

J.P. Morgan Self-Directed Investing is one of the top brokerage accounts available in 2023. Known for its reputation and financial expertise, J.P. Morgan offers a comprehensive suite of online trading tools and resources for investors of all levels.

Pros:

- Robust trading platform

- Extensive research and analysis

- Diverse investment options

- Educational resources

- Strong customer support

Cons:

- High account minimums

- Higher trading fees

- Limited geographic availability

9. Robinhood

Robinhood is one of the most well-known stock trading apps and online brokers for stocks in the market. Launched in 2013, it quickly gained popularity for its user-friendly interface and commission-free trading model. Let’s explore the pros and cons of using Robinhood as your stock broker in 2023.

Pros:

- Commission-Free Trading

- User-Friendly Interface

- Offers fractional shares

- Ability to trade options

Cons:

- Limited research and analysis tools

- Limited investment options

10. Ally Invest

Ally Invest is widely recognized as one of the best online brokers in 2023, offering a comprehensive suite of investment options and a user-friendly trading platform. As a subsidiary of Ally Financial, a trusted name in the financial industry, Ally Invest combines competitive pricing, robust research tools, and excellent customer service to cater to both beginner and experienced traders.

Pros:

- User-friendly trading platform.

- Advanced research tools

- Diverse investment options

- Strong customer support

Cons:

- Limited educational resources

- No Robo-Advisor option

11. Firstrade

Firstrade is an online brokerage that has gained significant recognition for its comprehensive offerings and user-friendly platform. With a focus on empowering individual investors, Firstrade has emerged as a top contender in the stock trading landscape. Let’s explore some of the key pros and cons of this popular brokerage.

Pros:

- Commission-free trading

- Extensive investment options

- Robust educational resources

Cons:

- Limited research tools

- No Robo-advisory service

- Limited international trading

12. eToro

eToro has emerged as one of the leading stock brokers in 2023, revolutionizing the online trading industry with its unique social trading platform. With a user-friendly interface and a wide range of features, eToro caters to both beginner and experienced traders. Let’s take a closer look at what makes eToro stand out from the crowd.

Pros:

- Innovative social trading

- User-friendly interface

- Diverse asset selection

- CopyPortfolios

Cons:

- Limited research and analysis tools

- Limited availability of some stocks

13. TradeStation

TradeStation is a renowned online brokerage that has consistently ranked among the best stock brokers in recent years. With its powerful trading platform and extensive range of features, it caters to both experienced traders and beginners looking to enter the world of online trading. Let’s delve into the pros and cons of TradeStation.

Pros:

- Extensive range of tradable instruments

- Advanced analysis tools

- Competitive pricing

Cons:

- Steep learning curve

- Account minimums

- Limited educational resources

14. DEGIRO

DEGIRO is a leading online brokerage that has gained a strong reputation among traders for its low-cost trading options. Established in 2013, this Dutch-based brokerage has quickly expanded its presence across Europe, attracting both seasoned traders and beginners alike. DEGIRO offers a comprehensive range of investment products, user-friendly platforms, and competitive pricing, making it an appealing choice for cost-conscious investors.

Pros:

- Competitive pricing

- Broad range of investment products

- User-friendly platforms

- International market access

- Strong security measures

Cons:

- Limited research and educational resources

15. Sofi Invest

Sofi Invest is a popular online brokerage platform that offers a range of investment options for traders and investors. Let’s take a closer look at this platform and its key features.

Pros:

- Best online brokerage for beginners

- Robust mobile app

- Fractional shares availability

- No account minimums

- Social investing

Cons:

- Limited investment options

- Limited research tools

- Lack of advanced trading features

Conclusion

We have provided an overview of the best stock brokers in 2023, showcasing their features, trading platforms, and stock trading apps. It is important that you carefully consider your specific needs and preferences when selecting a broker.

By choosing the one that aligns with your trading style and goals, you can make the most out of your investment journey. Select wisely and embark on a successful trading experience with the best stock brokers of 2023.

Frequently Asked Questions

1. What is the best stock broker to go with?

The best stock broker to go with depends on individual preferences, trading goals, and specific needs. Some popular options in 2023 include TD Ameritrade, E*TRADE, Charles Schwab, Interactive Brokers, and Robinhood. It’s essential to research and compare brokers based on factors such as fees, trading platforms, available investment options, customer support, and educational resources.

2. What is the most popular stock broker?

As of 2023, one of the most popular stock brokers is TD Ameritrade. It is renowned for its robust trading platform, Thinkorswim, which offers advanced tools and features. However, popularity can vary depending on factors like market trends and customer preferences, so it’s crucial to consider individual needs when choosing a stock broker.

3. Who is the biggest stock broker in the world?

The biggest stock broker in the world can be subjective and can change over time. However, some of the largest and most well-known stock brokers include Charles Schwab, Fidelity Investments, TD Ameritrade, and Interactive Brokers. These brokers have a significant market presence and cater to a wide range of investors.

4. What are the 3 different types of stock brokers?

- Full-Service Brokers: These brokers provide personalized advice, research, and a wide range of services. They typically charge higher fees but offer comprehensive support for investors.

- Discount Brokers: Discount brokers offer fewer services and lower fees compared to full-service brokers. They provide essential trading capabilities and execution services without extensive personal guidance.

- Online Brokers: Online brokers operate entirely through digital platforms. They offer self-directed trading options, advanced trading tools, and often have lower fees compared to traditional brokers. Online brokers are popular among active traders and independent investors.

5. How do I choose a broker?

To choose a broker, consider the following factors:

- Fees and Commissions: Compare the costs associated with trades, account maintenance, and any additional services or features.

- Trading Platform: Evaluate the user-friendliness, reliability, and functionality of the trading platform, as it is where you will execute your trades.

- Investment Options: Ensure the broker offers the types of investments (stocks, options, ETFs, etc.) you are interested in.

- Customer Support: Look for brokers with responsive and helpful customer support channels.

- Research and Educational Resources: Consider the availability of market research, educational materials, and tools to enhance your trading knowledge.

- Account Minimums: Some brokers may require a minimum deposit to open an account. Ensure it aligns with your budget.

- Security: Verify that the broker is regulated by reputable authorities and employs strong security measures to protect your personal and financial information.

6. Is Fidelity a stock broker?

Yes, Fidelity Investments is a well-known stock broker that offers a range of investment and brokerage services. They provide online trading platforms, investment options, research tools, and other financial services to individual investors, institutions, and financial advisors.

7. How to buy stocks for beginners?

To buy stocks as a beginner, follow these steps:

- Research and educate yourself about the basics of investing and stock markets.

- Choose a reliable and user-friendly online brokerage platform.

- Open an account by providing the required personal and financial information.

- Deposit funds into your brokerage account.

- Research and select the stocks you wish to invest in, considering factors such as company performance, financials, and market trends.

- Use your broker’s trading platform to place an order to buy the desired stocks. Specify the number of shares and the price at which you want to buy.

- Monitor your investments regularly and make informed decisions based on your investment goals and market conditions.

For a more details you can check Stock Market Investing for Beginners

8. How to start stock trading?

To start stock trading, follow these steps:

- Educate yourself about stock markets, trading strategies, and risk management.

- Determine your investment goals and risk tolerance.

- Research and choose a reliable online brokerage platform that suits your trading needs.

- Open an account by providing the necessary personal and financial information.

- Deposit funds into your trading account.

- Familiarize yourself with the trading platform, order types, and tools provided by your broker.

- Build a trading plan and strategy based on your goals and risk tolerance.

- Begin by practicing with virtual trading or paper trading to gain experience without risking real money.

- Start executing trades by placing buy or sell orders based on your analysis and strategy.

- Continuously monitor your trades, review your performance, and adjust your strategies as needed. Regularly educate yourself about market trends and news to make informed decisions.

Stock Market Investing for Beginners is a comprehensive guide to start stock trading. You should check it out.

Pingback: A Comprehensive Beginner Guide to Stock Market Investing [2023] - Pro Finance Wizard Pro Finance Wizard

Pingback: Impact of Futures Trading on Stock Market Volatility - Pro Finance Wizard

Pingback: Seasonal Trading Strategies in Stock Market Futures [2023] - Pro Finance Wizard